Finnish sauna culture has been inscribed by UNESCO on the official list of intangible cultural heritage of humanity. The sauna is part of an eternally developing and alive form of everyday routine, which is splendidly exemplified by the new wellbeing concept of Saunafulness.

Saunafulness is all about holistic wellness, the aim of which is to help you relax. The heart of Saunafulness is the sauna and its heat therapy. Fulness, in turn, refers to a holistic approach that combines exercises and wellness to positively impact both mind and body.

It’s only natural that the beneficial effects of sauna – confirmed by many researchers – have mid-wifed a new model for sauna wellness. In her new book, Carita Harju sheds light on the diverse and multifold health benefits of the sauna and how the sauna has increasingly become a source of wellbeing by reducing stress, strengthening the heart, and improving sleep quality.

Saunafulness is divided into two parts. The first part offers the reader ample information on the health benefits of sauna, based on numerous studies, and presented in easily accessible writing. The second part provides the reader with a variety of natural wellbeing exercises that anyone can adapt to fit their own specific wishes. The exercises unite the mind, the body, one’s health, and all the different senses. Saunafulness can be practiced in any sauna with easy-access materials accompanied by clear instructions.

The saunafulness method developed by Harju fits like a glove in the sense that, by going to a sauna, you could find within yourself the resources to process the traumas and stresses of your life, and learn how to throw the bruises of working life and increased hate speech on the sauna stove like water.

Kaarina Kailo, docent, sauna researcher, author

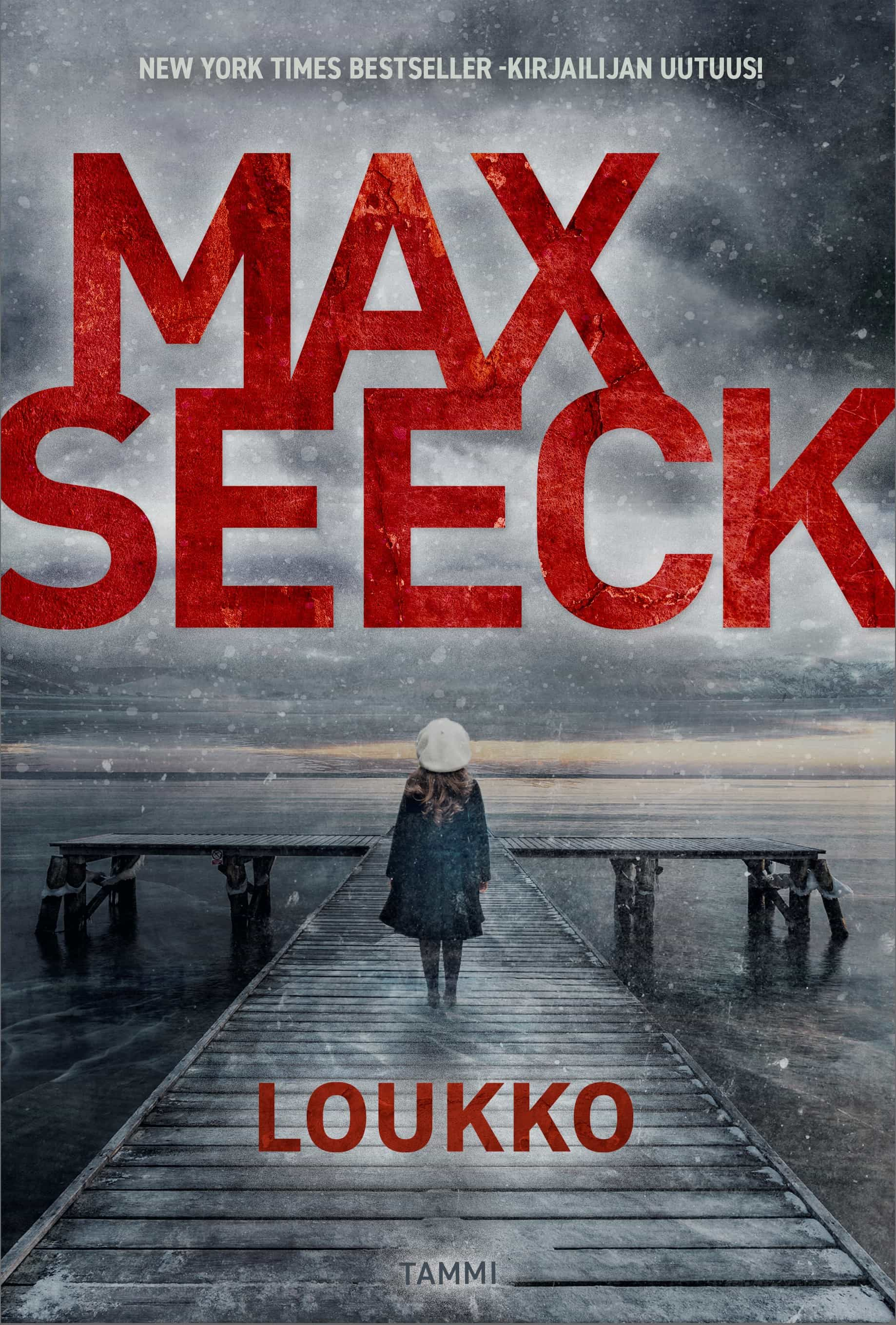

Loukko by

Loukko by